Banking

Banking

Hampden & Co was set up to be unlike other banks. The kind of bank where we know you not as an account number, but as a person. Our banking services are extensive and we are able to support you in a wide range of ways.

Day to day banking

We provide clients with a current account and offer MasterCard debit and charge cards, cheque books and overdrafts for your everyday banking needs.

Digital banking

Online banking and our mobile apps give you convenient and secure access to your accounts. Find out more about digital banking and the benefits of accessing your account online.

Banking safely

Find out more about the steps we take to keep your finances safe from fraud, and the actions we recommend for you to take.

Apple Pay

Enjoy all the benefits of your Hampden & Co Debit or Charge Card using Apple Pay. A safe, contactless way to pay with your iPhone and Apple Watch.

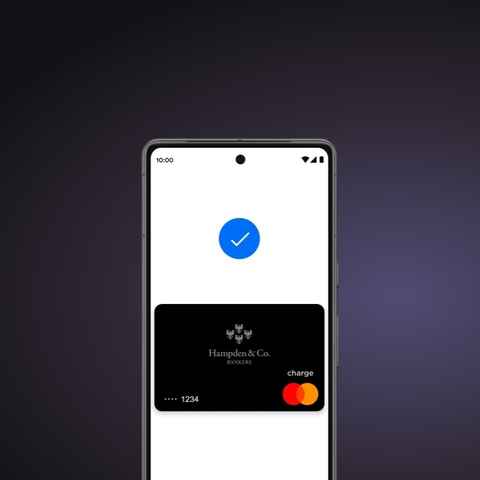

Google Pay

Link your Hampden & Co debit or charge card to your Android smartphone. For a fast, convenient and secure way to make cashless payments.

Sort Code Checker

When making a payment to Hampden & Co or to any other bank account, whether it’s an online payment or a Direct Debit, you may wish to verify the sort code and the types of payment you can make.

To do this independently, Pay.UK has created a sort code checker which is available on their website at Sort code checker (wearepay.uk).