Working with us

Join our team

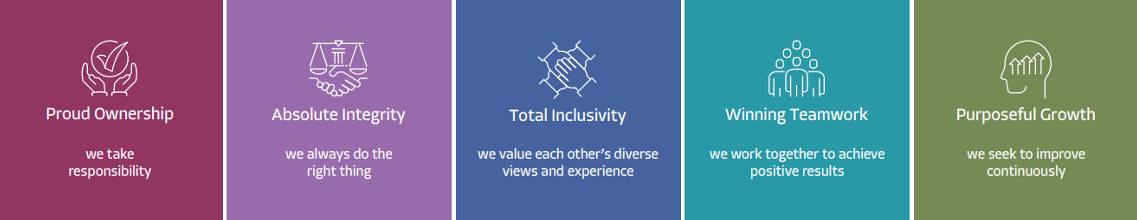

As a growing and ambitious company with an inclusive culture, we seek people to join our team who share our values. To deliver the exceptional levels of service we expect, our colleagues think of our clients, take ownership of their responsibilities and work together to deliver at pace. We call this ‘The Hampden Way’.

In return, we offer exciting career opportunities through professional and personal development, within a challenging and supportive environment. We also offer an excellent range of employee benefits.

Our values

Meet our people

Manahil Sheikh

Manahil is a Financial Analyst in our Finance team.

Georgina King

Georgina is an Assistant Banking Manager working within our banking team based in London.

Crawford Philpot

Assistant Banking Manager Crawford works in our Edinburgh-based banking team.

Andrew Morgan

Andrew is an Assistant Manager in our Banking Operations team.

Current vacancies

We are hiring a Payment Services Analyst to join our Banking Operations team based in Edinburgh.

The purpose of the role is to ensure the timely and accurate processing of client data and transactions in the payments process. In this role, you will ensure that excellent client service is provided and the expectations of Hampden & Co clients are met.

The ideal candidate for the role will:

- Excellent organisational and time management skills.

- Ability to work accurately under pressure and meet deadlines.

- Strong attention to detail.

- A strong level of computer literacy and keyboard skills.

- Self-starter and team player.

- Desire to learn and enhance skills and knowledge.

- Experience and knowledge of banking processes or similar is desirable (but not essential).

- Experience in a similar role is desirable (but not essential).

Main responsibilities / key duties:

- Ensure exceptional client service is maintained across the team, including but not exclusively:

- Processing of clients’ payment instructions

- Process Sterling and other currency payment types using industry standard payment mechanisms including, Faster Payments, CHAPS, and SWIFT

- Reconciliations

- Support the Treasury function in the execution of its services including foreign exchange and money market deals and confirmations

- Fraud prevention measures for all payment types and transactions

- Ensure Service Level Agreements are met.

- Participate in project and change activities relevant to the team and the department.

- Provide support and temporary absence cover for colleagues.

- Any other related tasks which may be assigned from time to time which are reasonable in relation the role and skills and experience.

About the role

We have an excellent opportunity for an Application Support Analyst to join our IT team in Edinburgh.

The role is responsible for supporting the Bank’s core applications (inc. Oracle Flexcube1, Document Management System, Managed File Transfer Integration, CRM). Support duties include; daily batch management, requirements analysis and design of changes, configuration and release management, environment management, oversight of third-party suppliers, incident management, problem management (level 1 & 2 technical support).

This role is suited to you if you are motivated to work as part of a team, to take ownership of their responsibilities and to deliver at pace.

The ideal candidate for the role will have:

- Familiarity with Core Banking platforms.

- Understanding of UK Payment mechanisms, inc. the relevant UK regulations and directives.

- Fluent with SQL and have experience with database design and large data sets.

- Excellent knowledge of Oracle applications, databases and tools (inc. PL/SQL) would be beneficial.

- Experience in service delivery framework (ITIL Infrastructure Library).

- Design and implementation experience of Database, Middleware & API.

- Strong understanding of software architecture principles and design patterns.

- Ability to work accurately under pressure and meet tight deadlines.

- Ability to manage multiple tasks simultaneously.

- Excellent attention to detail and high levels of accuracy.

- Good analytical and problem-solving skills.

- Good organisational and time management skills.

- Excellent verbal and written communication skills.

- Be a team player, detail oriented, focused on quality to ensure the team’s success.

Main responsibilities / key duties:

- Administration of multiple core application platforms (e.g. configuration, database, parameterisation, scripting).

- Work with stakeholders and change teams to determine requirements for core platform change requests and subsequent impact analysis and design.

- Design and implement solutions that optimise performance, supportability, security and resilience.

- Identify and troubleshoot issues and incidents in core applications and propose resolution in a timely manner.

- Provide 1st line / 2nd line application support to colleagues across the Bank (inc. functional subject matter expertise / internal consultancy).

- Oversight of third-party IT suppliers (including hosting and managed service partners).

- Manage core application configuration and environments.

- Support operation of key IT controls (incl. role-based access control, release management).

- Support daily batch operations and regular security patching (outside of working hours).

- Focusing on long-term business and technology objectives, identify opportunities for investment and continual improvement.

About the role

We have an excellent opportunity for Solutions Designer to join our Solutions, Design & Digital team in Edinburgh.

The role is required bridge the gap between business needs and technical capabilities by creating solutions and supporting initiatives across the entire business. Responsible for documenting, updating, and owning enduring design artifacts for the Bank. Supporting Digital Product Ownership is a large part of the role.

This role is suited to you if you are motivated to work as part of a team, to take ownership of their responsibilities and to deliver at pace.

The ideal candidate for the role will have:

- Excellent attention to detail and high levels of accuracy.

- Strong problem solving-skills, with a creative and analytical approach.

- The ability to manage expectations and meet agreed deadlines.

- Highly organised with the ability to manage multiple and changing priorities at once.

- Works effectively under pressure.

- Thinks outside the box but works with integrity and discretion.

- Self-motivated and pro-active.

- Undertake or support ad-hoc business projects as required.

- Ability to develop and maintain strong relationships with stakeholders.

- Ability to challenge stakeholders to reach feasible solutions.

- Effective interpersonal and communication skills (both written and oral).

- Presents appropriate recommendations in a clear, concise, and accurate manner.

- Pro-active, with the ability to work alone where required.

- A dedicated team player.

- Contributes positively to team morale.

- Contributes to ideas and group discussions.

- Suggest amendments to policies and procedures to support the Bank’s continuous improvement process.

Main responsibilities / key duties:

- Interpret and support the elaboration of business requirements.

- Translate business requirements into solution design options and recommendations.

- Devise and design appropriate technology enabled solutions for any part of the business taking client and colleague needs, cost, risk, resilience, regulation, and security into consideration.

- Work with the business, product teams, IT, change, third party suppliers and other external stakeholders to agree proposed solutions, ensuring trade-offs and risks are understood.

- Document solutions, interfaces, and interactions, working to simplify complex designs and explain design options and recommendations clearly to various stakeholders.

- Supporting (no execution) testing, triaging, and troubleshooting results

- Maintain a library of standard design and architecture documents and promote its use.

- Understand design proposals from external suppliers, and support and present recommendations to senior stakeholders.

- Create design deliverables that meet security and web / digital standards (incl. accessibility).

- Participate and occasionally lead in sharing best practice and adoption of design standards, trends and patterns to develop products and services.

- Contribute to ongoing business plans, including budget forecasting and monitoring.

- Contribute to strategy with understanding of the whole business context.

- Digital & technical product ownership and supplier management.

- Digital application support.

- Support incident resolution with business, system, and architecture knowledge.

- Business or technical lead for change portfolio initiatives.

- Responsible for visual design system for digital client experience.

We have an excellent opportunity for a Credit Risk Manager to join our Risk & Compliance team in Edinburgh.

Reporting to the Head of Credit, the Credit Risk Manager will build an expert knowledge of the Bank’s Risk Appetite, and Policy Framework to engage with and deliver key stakeholder messages on this to Bankers and Senior Management.

They will prepare and deliver ongoing training programmes, focus on scalability through the enhancement of policy, standards, procedures, and processes and driving efficiency, positively impacting the client journey. The Credit Risk Manager will prepare and present reports / MI information to Credit Committee and other key stakeholders.

This role is suited to you if you are motivated to work as part of a team, to take ownership of their responsibilities and to deliver at pace.

The ideal candidate for the role will have:

- Hold relevant professional banking qualification e.g., Chartered Banker Institute.

- A proven track record of conducting oversight and providing challenge in a credit risk environment.

- Experience in Credit Underwriting (including financial difficulties) Training, Policy, Governance and Controls - covering personal and non-personal lending, with proven analytical skills and ability to interpret financial accounts to exercise sound and pragmatic judgment.

- Technical specialist and ability to apply knowledge of control systems, processes, reporting and regulatory requirements in relation to Credit Risk.

- Proven track record of implementing and embedding processes / procedures that make a difference to colleagues, clients and ultimately the Bank.

- Proven track record of preparing and delivering effective training.

- Diverse knowledge of financial, business, economic and property markets.

- Resilient and calm under pressure.

- Ability to work with others to effectively embed change.

Main responsibilities / key duties:

- As a subject matter expert, provide credit risk guidance to the Head of Credit Risk, the Chief Risk Officer, the Executive Risk Committee, the Board Risk Committee, and other colleagues, as required.

- Coach / mentor / train colleagues (the Credit Risk Team and Banking Directors).

- Credit Risk Oversight in all aspects of Credit Risk Management, including lending decisions and thematic reviews.

- Hold a Delegated Sanctioning Authority which includes decision making on clients in financial difficulty.

- Engage with the Commercial team to support clients in financial difficulty to find a mutually acceptable solution for both the client and the Bank.

- Input to discussions with the Head of Credit and Senior Credit Risk Manager on financial difficulty cases, provisions on accounts which are in default and any write-offs.

- Input to day-to-day Policy / Governance / Appetite discussions within the Credit Risk Team and with other stakeholders.

- Review and analyse credit risk data and present Management Information to Credit Committee.

- Credit Risk subject matter expert in relation to the Financial Risks from Climate Change.

- Keep up to date with credit risk regulatory requirements and maintain a detailed knowledge of the Bank’s lending products and their inherent credit risks.

- Ensure risk events such as breaches and operational losses are escalated and reported in accordance with Policy.

- Build and maintain constructive and effective relationships across the business in line with the Bank’s culture and behaviours.

- Participate in working groups, either within the Credit Risk Team or across the Bank to continuously improve processes and procedures and contribute to the Bank’s success.

- Instil a culture of on-going improvement, development, and sustainability in all aspects of credit risk management.

Interested in working at Hampden & Co?

If you would like to know more about the roles available or about working at Hampden & Co, please contact our People Team.

Benefits

In addition to a competitive salary, we offer:

35 days annual leave, including public holidays

Salary exchange pension scheme

Discretionary variable pay award

Discretionary company share option

Group Life Assurance scheme

Private Medical Health Insurance

Health Cash Plan

Employee Assistance Programme

Enhanced maternity pay

Volunteering program

Give as you earn

Season ticket loan scheme

Cycle to Work scheme

Electric Car scheme

Annual flu vaccination

“Our reputation is built on the service we provide to our clients. We seek to recruit and develop people who share our passion for service excellence and who are committed to working together to help our clients achieve their aspirations.”

Career opportunities

To be kept up to date with career opportunities, follow us on LinkedIn.